GST holiday created more problems than sales: CFIB

Posted February 11, 2025 12:23 pm.

Last Updated February 11, 2025 3:11 pm.

The Trudeau government’s GST holiday has done little but cause headaches for Canada’s small and medium-sized enterprises (SMEs), according to a survey conducted on behalf of the Canadian Federation of Independent Business (CFIB).

According to the survey, only five per cent of SMEs saw their sales increase compared to last year. A breakdown of the data also shows that only four per cent of SMEs in the retail sector and 15 per cent in the hospitality and food services sector saw an increase.

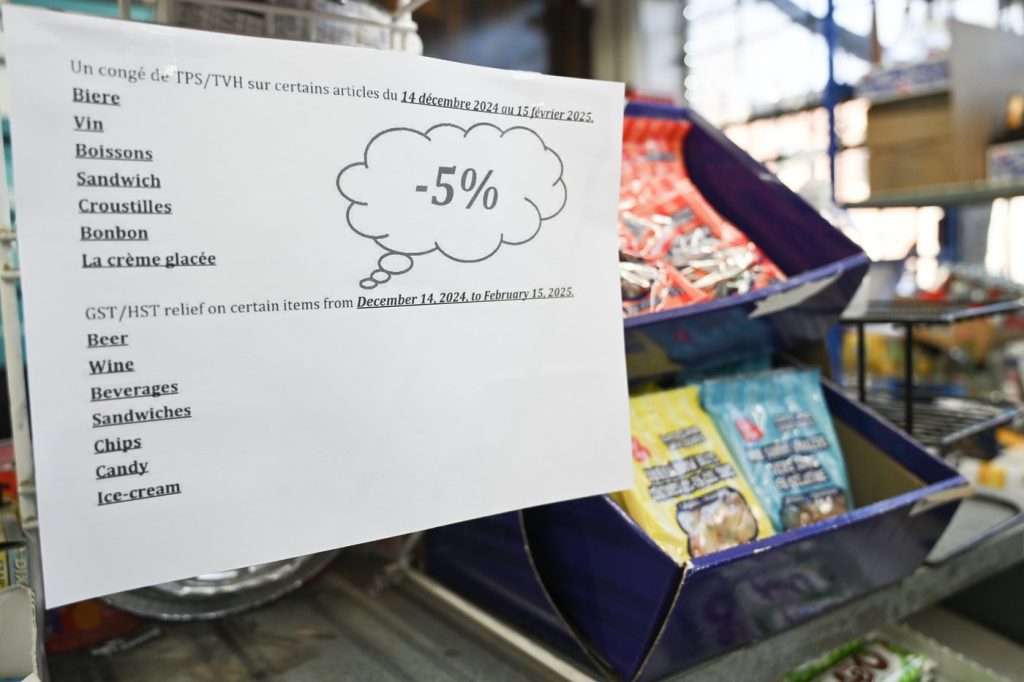

The GST holiday, which affected only certain products, will end on Feb. 15, two months after it came into place in mid-December.

Major challenges and costs

Two-thirds (66 per cent) of SMEs affected by the tax holiday, in addition to seeing no increase in sales, report having to deal with significant challenges, including reprogramming point-of-sale systems — requiring time and money — and training employees to administer the exemption and manage customer queries.

This was echoed by comments made two weeks ago by Metro President and CEO Éric La Flèche on the sidelines of the company’s annual meeting, which brought together Metro, Super C and Jean Coutu: “I’m sure it was appreciated by customers, but for us, both in grocery stores and pharmacies, we haven’t seen an increase in demand because of it,” he said at the time.

This was in line with the findings of the survey, with the business leader stating that “it was a lot of work for our team to implement it in December, a very busy period.”

CFIB’s vice-president of national affairs, Jasmin Guénette, stated in a press release that “clearly, the government’s GST holiday has not produced the desired results. For many retailers, reprogramming point-of-sale terminals just before Christmas and figuring out which products the exemption applied to was an administrative nightmare.”

The red tape heavyweight prize

The CFIB, which represents some 100,000 SMEs across Canada, has criticized the government’s inconsistency, blaming the Canada Revenue Agency (CRA) and Finance Canada for providing contradictory information on whether or not a business needed to participate in the tax holiday. This measure was given the dubious honour of receiving the “Paperweight Award” as CFIB marked the 16th annual Red Tape Awareness Week. The award highlights the worst examples of excessive red tape in the country.

Guénette points out that affected SMEs must now reprogram their systems by next Saturday, and asks the CRA “to be lenient and cancel all penalties and interest that may be owed due to errors made in good faith by merchants during this period.”

Even more, Guénette asked the government to grant a $1,000 credit to the GST/HST accounts of affected businesses “to offset the costs this measure has generated.”

CFIB’s “Your Voice Survey” was conducted online from Jan. 9-31, among 2,345 of its members. By contrast, the margin of error is +/- 2.02%, 19 times out of 20, for a sample of this size.

–This report by La Presse Canadienne was translated by CityNews