Quebec government wants to ‘clean-up’ tipping with bill to regulate how merchants can ask for tips

Posted September 12, 2024 10:24 am.

Last Updated September 12, 2024 6:15 pm.

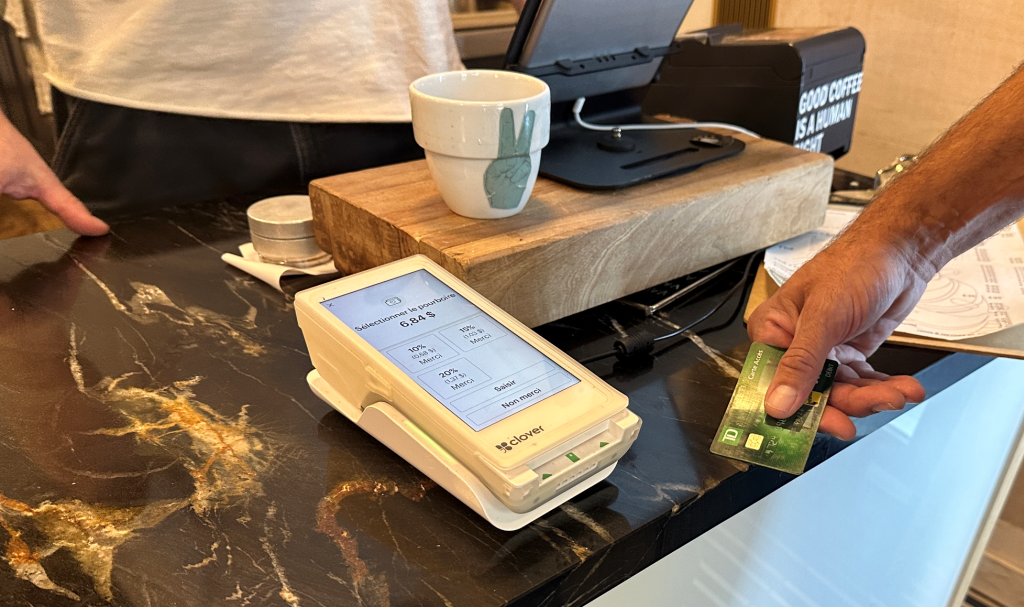

The CAQ government wants to remove some of the pressure that consumers face at restaurants.

Simon Jolin-Barrette, minister responsible for consumer protection, has tabled a bill to force merchants to calculate tips based on the price before tax.

That means on a restaurant bill of $100, suggested tips would be calculated based on $100, not on $114.98 after provincial and federal sales taxes are added.

“I think that’s a measure of transparency follow the consumer because we know that all the families in Quebec have some difficulties with their budget,” said Jolin-Barrette.

The “Act to protect consumers against abusive commercial practices and to provide greater transparency in terms of prices and credit” goal is to alleviate some of the “annoyances” that consumers face everyday and to impose more transparency in stores to allow customers to make better choices according to their budget.

Proposing a tip amount or percentage based on the total before taxes “is the social convention,” said Jolin-Barrette, at a press conference Thursday morning, adding that the CAQ government has been aware of the tipping issues for the past few months and that customers report feeling anxious about the tipping options.

“I’m also a customer, so I also get surprised sometimes by the amount,” said Jason Malo, founder and co-owner of Café Humble Lion in downtown Montreal.

“We don’t want to be condescending in the way that we thank or ask for the tips, but as the owner of business, we need to subsidize otherwise we will increase our prices and we’re not too sure if this type of business exists anymore in today’s economy,” he added.

In some cases, certain amounts have an emojis beside it to encourage customers to be more generous, while machines don’t offer tipping options lower than 18 per cent, although the average is 15 per cent.

“It’s a question of honesty,” Jolin-Barrette argued.

“In restaurants, more and more, people find themselves under pressure with the terminal and they have to pay right away, whereas in the past, people were presented with a bill, then afterwards we’d come back with the terminal.”

#WATCH: “A measure of transparency,” says Simon Jolin-Barrette, Quebec minister responsible for consumer protection, as he tabled a bill that sees to curb excessive tipping. It would force merchants to calculate tips based on the price before tax.

— CityNews Montreal (@CityNewsMTL) September 12, 2024

READ: https://t.co/ak9EC0hILP pic.twitter.com/1Cwd0EUp32

This approach may be more fair for customers, according to Malo. He says it would be better if the terminal could calculate the tip before taxes.

For Moshe Lander, economics professor at Concordia University, he says there is no reason to legislate this. He says this will only add to compliance and administrative costs.

“In my day, tips were 15 per cent on the pre-tax number and if the service was exceptionally good, you could increase it, it it was exceptionally bad, you could decrease it,” he said. “Now it seems that it’s 18 per cent on the after-tax bill, but that’s the reason why there’s a button that says ‘other amount.’

“If I don’t like the way that they’re the calculating the tax, then I calculate it my own way and if the business doesn’t like it, then I’m taking my business elsewhere,” he added.

Why doesn’t the government go further and prohibit tipping, for example at a bakery, in a café where there’s no table service?

“Tipping is always a discretionary choice on the part of the consumer,” argued Jolin-Barrette. “The government isn’t there to say: you’ll tip at this place and you won’t tip at that other place.”

Some Montrealers say there should be a shift in the tipping culture, with one saying it should not be “automatic.”

“This whole tipping culture will continue to exist or we might have to consider how we’re consuming,” said Malo.

The legislation stipulates that the same unit of measurement must be used for all products of the same nature, and must be sufficiently visible to facilitate comparison.

Also, the regular price must be clearly indicated when an item is sold below its usual price.

The unit price should be sufficiently visible in relation to the multiple purchase price when items can be purchased separately.

Finally, in the case of loyalty programs, the price for non-members will have to be sufficiently visible in relation to the price for members.

The bill also provides for an increase in the compensation offered to consumers when the price of a good recorded at the checkout is higher than the advertised price for merchants using optical reader technology.

The rebate would rise from $10 to $15 in the event of an error when the price read by an optical scanner at the checkout is higher than that indicated on the shelf or in the flyer. The item would therefore be free if its value is less than $15; and if its value exceeds $15, the consumer would pay the balance once the $15 discount has been applied.

“Balloon” loan

The government also wants to tighten the screws on car dealers when it comes to financing by attacking the so-called “balloon” loan, without banning it.

It is negative equity: it consists in deferring the debt of the vehicle you haven’t finished paying off onto the loan of the new vehicle you’re buying.

“In some cases, citizens end up paying double what they should for the value of a vehicle,” said Jolin-Barrette.

The higher the value of the “balloon,” the more buyers choose to spread their financing over a longer period, which has other perverse effects.

“When the useful life of the vehicle is less than the financing period, it becomes virtually impossible to get out of the debt spiral,” said the minister. “As a result, the debt is deferred once again, and the consumer may find himself paying for several years for an old vehicle he no longer even owns.”

Quebec wants to set conditions. In particular, the dealer will have to inform the consumer, before the contract is signed, that the net capital of the contract will include the balance of the previous debt.

The balance of the previous debt must also be clearly mentioned on the contract.

Heating and air conditioning

Jolin-Barrette also wants to put some order into a sector that alone generates an average of 400 complaints a year to the Office de protection du consommateur: heating and air-conditioning appliances, as well as insulation and decontamination services.

He referred to “unfair and deceptive practices” in door-to-door sales.

For example, “some contractors offer to inspect attics and claim to have found mold by displaying photos taken elsewhere,” he said.

If the law is passed, it will therefore be forbidden for a travelling salesperson to enter into a sales or rental contract for “a heating or air-conditioning appliance, including an air conditioner, heat pump, furnace or geothermal system (….), a decontamination service” and an “insulation service.”

These types of travelling salespeople account for more than a quarter of convictions under the Consumer Protection Act since 2019, Jolin-Barrette said.

The bill will be the subject of consultations and detailed study by a parliamentary committee.

-With files from The Canadian Press